Breakout Trading Secrets : A Beginner’s Guide to Spotting Big Moves and Making Smarter Trades

Breakout Trading secrets: A Beginner’s Guide to Spotting Big Moves and Making Smarter Trades If you’ve ever wondered how traders spot those big market moves just before they happen, then breakout trading might be worth a look. This trading style focuses on capturing price jumps that often happen when a stock, currency, or crypto asset … Continue reading "Breakout Trading Secrets : A Beginner’s Guide to Spotting Big Moves and Making Smarter Trades"

Breakout Trading secrets: A Beginner’s Guide to Spotting Big Moves and Making Smarter Trades

If you’ve ever wondered how traders spot those big market moves just before they happen, then breakout trading might be worth a look. This trading style focuses on capturing price jumps that often happen when a stock, currency, or crypto asset “breaks out” of its usual price range. It’s all about timing, pattern recognition, and understanding what makes prices tick.

In this guide, we’ll break down the essentials of breakout trading, explain how to identify real opportunities, and highlight some common pitfalls you’ll want to dodge. Whether you’re new to trading or just curious about breakout strategies, keep reading—you might just find the boost your trading game needs!

What Exactly is Breakout Trading?

Breakout trading is pretty much what it sounds like—trying to catch a big move when the price “breaks out” of a consistent range or chart pattern. In simpler terms, traders are looking for moments when an asset (like a stock, currency pair, or crypto coin) stops moving sideways and bursts up or down, often in a strong, fast way. The idea is to jump on the breakout train early and ride the momentum before everyone else catches on.

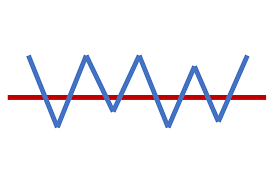

A typical breakout happens when the price goes above a key “resistance” level (the price ceiling) or falls below “support” (the price floor). Think of resistance and support like invisible fences—prices often “bounce” off them. But when they finally break through, it can signal that the market’s ready for a new direction.

Key Ingredients for Breakout Trading Success

A solid breakout trade relies on a few essential factors:

•Support and Resistance: These levels help show where prices tend to “bounce” and reverse. Resistance acts as the upper cap, while support is the lower cushion.

•Volume: Breakouts work best when lots of people are trading the asset. Higher trading volume adds credibility to a breakout, while a weak volume often suggests it may be a false alarm.

•Timing: Breakouts can happen anytime but are more likely during times of higher activity, like when markets open or major news breaks.

Want to learn more about support, resistance, and volume? Check out Mavi Analytics’ Technical Analysis Guide to get started with the basics.

Popular Breakout Trading Strategies

There are a few main approaches to breakout trading. Each one fits different market conditions, and knowing when to use which can make all the difference.

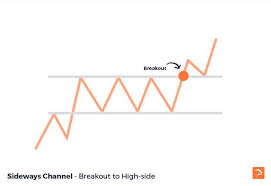

1. Range Breakouts

Range breakouts happen when the price has been bouncing around in a narrow range for a while, then finally escapes. Traders usually see this as a sign that momentum could be building in the breakout direction.

•Best for: Sideways or flat markets where prices aren’t making big moves

•Tip: Use extra indicators like the Relative Strength Index (RSI) to make sure the breakout is likely to stick.

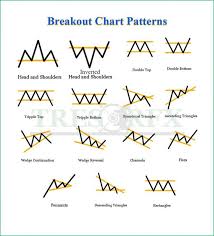

2. Chart Pattern Breakouts

This strategy looks for well-known chart patterns, such as triangles, flags, and head-and-shoulders. When prices break out of these shapes, it can hint at a trend reversal or continuation.

•Best for: Trending assets, where you can spot obvious patterns

•Tip: Spend some time learning these patterns and try spotting them in historical charts to sharpen your skills.

3. Momentum Breakouts

This approach zeroes in on assets that are already moving fast in one direction. Here, traders hope to ride the momentum further when a breakout occurs.

•Best for: Assets that have high volatility and are prone to strong, directional moves

•Tip: Check tools like Moving Average Convergence Divergence (MACD) to confirm if momentum is really on your side.

For more details on trading patterns and indicators, have a look at Investopedia’s guide on trading strategies.

Spotting Potential Breakouts: Tools and Tips

A big part of breakout trading success is knowing how to spot potential setups. Here are some handy tips:

1.Mark Support and Resistance: These levels are your guideposts. Keep them on your chart to watch for breakouts.

2.Check Volume: Higher trading volume during a breakout can be a green light. Low volume breakouts are often weak and more likely to reverse.

3.Use Moving Averages: Long-term moving averages, like the 200-day or 50-day, can act as additional support or resistance and help confirm breakouts.

4.Look at RSI: The Relative Strength Index (RSI) shows if an asset is overbought or oversold, which can add weight to a breakout signal.

Want to explore more tools and indicators? Mavi Analytics’ advanced indicators page is a great place to start.

Why Traders Love Breakout Trading

Breakout trading can be thrilling because it’s all about capturing fast, significant price moves. Here’s why it’s a popular choice:

•Potential for Big Profits: Breakouts often lead to large, quick moves, allowing traders to profit swiftly.

•Clear Entry/Exit Points: Support and resistance levels provide straightforward points for entering and exiting trades.

•Market Versatility: You can use breakout trading in nearly any market, whether it’s stocks, forex, or crypto.

•Built-in Momentum: Since breakout trading aligns with price momentum, it often rides the wave of investor sentiment.

For those interested in breakout trading within the forex market, BabyPips has some great educational materials for learning forex-specific strategies.

Risks in Breakout Trading (and How to Handle Them)

Like any trading strategy, breakout trading isn’t foolproof. Here’s a look at some common risks and how to manage them smartly:

1. False Breakouts

A false breakout happens when the price briefly moves beyond support or resistance but quickly reverses, trapping unsuspecting traders.

•Solution: Confirm the breakout with volume. If the volume is high, it’s a more credible breakout.

2. Whipsaw Movements

Whipsaws are quick reversals right after a breakout, often due to unexpected news or announcements. They can be frustrating and costly.

•Solution: Use a stop-loss order to limit your losses. Place it just beyond the support for a long trade or above resistance for a short trade.

3. High Volatility

While volatility can lead to profits, it also comes with rapid, sometimes erratic movements that can turn against you.

•Solution: Be cautious around events like earnings reports or economic announcements, which can increase volatility.

If you want more insights into handling risks in trading, check out Mavi Analytics’ risk management strategies page.

Pro Tips for Breakout Trading Success

If you’re considering breakout trading, here are a few practical tips to keep in mind:

•Plan Ahead: Define your entry, exit, and stop-loss points before you jump into a trade.

•Use Multiple Indicators: Combining tools like RSI, volume, and moving averages can help you confirm a breakout.

•Adapt to Market Conditions: Be flexible with your strategy, adjusting it based on the overall market trend.

•Don’t Chase Every Move: Not every breakout is worth trading. Be selective and avoid chasing trades out of impatience or fear of missing out.

For more tips on trading, you might find TradingView’s blog on trading strategies helpful.

The Bottom Line: Is Breakout Trading Right for You?

Breakout trading can be exciting, especially if you’re drawn to quick, impactful trades. It’s not without risks, of course, but for those who learn to manage false breakouts, time their trades, and adapt to market conditions, it can be a valuable tool.

For more resources on trading and analysis, don’t forget to explore Mavi Analytics for guides on everything from technical indicators to risk management.

Breakout trading isn’t a one-size-fits-all approach. It requires discipline, practice, and a good understanding of the tools involved. But if you’re up for the challenge, it could add a powerful new dimension to your trading strategy.

Update: Nov 02, 2024

Update: Nov 02, 2024 8 mins

read

8 mins

read