Discover 5 proven swing trading strategies ! Learn what is swing trading and Its magic

5 Proven Swing Trading Strategies to Maximize Your Profits Swing trading strategies are powerful trading strategies where traders aim to capture short- to medium-term gains in a stock or any financial instrument over a period of days to weeks. Unlike day trading, which requires constant monitoring, swing trading offers more flexibility, making it suitable for … Continue reading "Discover 5 proven swing trading strategies ! Learn what is swing trading and Its magic"

5 Proven Swing Trading Strategies to Maximize Your Profits

Swing trading strategies are powerful trading strategies where traders aim to capture short- to medium-term gains in a stock or any financial instrument over a period of days to weeks. Unlike day trading, which requires constant monitoring, swing trading offers more flexibility, making it suitable for part-time traders. In this blog, we’ll cover 5 proven swing trading strategies that can help you maximize profits while effectively managing risk

Table of Contents:

1. What is Swing Trading?

2.1. Moving Average Crossover Strategy

3.2. RSI Strategy (Relative Strength Index)

4.3. Fibonacci Retracement Strategy

5.4. Breakout Strategy

6.5. MACD (Moving Average Convergence Divergence) Strategy

7.Conclusion

What is Swing Trading?

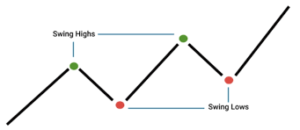

Swing trading is a style of trading that aims to capture gains in a stock (or any financial instrument) over a few days to several weeks. Traders take advantage of “swings” in price movement, buying at support levels and selling at resistance, or vice versa. Successful swing traders use technical analysis and proven strategies to predict when the price will rise or fall, aiming for quick, consistent profits. For best free charting tool, you can use http://investing.com

1. Moving Average Crossover Strategy

The Moving Average Crossover strategy is one of the most popular and straightforward swing trading strategies. It involves two moving averages (MAs), usually the 50-day and 200-day moving averages.

• How it works: When a short-term moving average (e.g., 50-day) crosses above a long-term moving average (e.g., 200-day), it generates a buy signal. Conversely, when the short-term MA crosses below the long-term MA, it signals a sell opportunity.

Example:

A stock chart with a 50-day and 200-day moving average line would show two key moments—when the short-term moving average crosses above the long-term (bullish) and when it crosses below (bearish).

• Why it works: Moving averages smooth out price fluctuations, helping traders identify trends and reduce noise in the market.

•Pro Tip: Combine moving averages with other indicators like volume to confirm trend reversals and avoid false signals. https://mavianalytics.com provides the best education on swing trading through courses, blogs, and books.

2. RSI Strategy (Relative Strength Index)

The Relative Strength Index (RSI) strategy is another effective swing trading approach. RSI is a momentum oscillator that measures the speed and change of price movements. It fluctuates between 0 and 100 and helps traders determine whether a stock is overbought or oversold.

•How it works:

• When RSI is above 70, the stock is considered overbought, signaling a potential sell opportunity.

• When RSI is below 30, the stock is considered oversold, indicating a buying opportunity.

Example:

Imagine a chart where the RSI dips below 30. This oversold condition often signals that a price rebound is imminent.

• Why it works: The RSI identifies reversal points, helping traders buy low and sell high. Swing traders can exploit these extremes to take positions at optimal points.

•Pro Tip: Look for divergences between the stock’s price and the RSI, which often indicates a potential reversal.

3. Fibonacci Retracement Strategy

The Fibonacci Retracement strategy is based on key support and resistance levels derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. These retracement levels are often used to determine potential reversal points in the market.

•How it works:

• Fibonacci retracement levels typically include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

• When a stock pulls back to one of these levels during a strong trend, it often presents an excellent opportunity to enter the market.

Example:

A stock chart might show an upward trend, followed by a pullback to the 61.8% Fibonacci retracement level. This is often a prime buying zone.

• Why it works: These levels are widely respected by traders and serve as self-fulfilling prophecies. Many traders place their buy/sell orders around these retracement levels, enhancing their validity.

• Pro Tip: Combine Fibonacci retracement with candlestick patterns to confirm entry points.

4. Breakout Strategy

The breakout strategy involves entering a trade when the price breaks out of a defined resistance or support level. Breakouts often indicate the start of a new trend, making them powerful entry points for swing traders.

•How it works:

• A breakout occurs when the price moves above a resistance level or below a support level with increased volume.

• After the breakout, the price typically continues in the direction of the breakout for a few days or weeks, offering the trader a potential swing trading opportunity.

Example:

A stock may have been consolidating between $50 and $55 for several weeks. When it breaks above $55 with high volume, this is a bullish breakout, signaling a strong buy opportunity.

• Why it works: Breakouts signal strong momentum and often indicate the beginning of a new trend.

•Pro Tip: Look for breakouts on high volume for confirmation, and avoid false breakouts by checking for price consolidation before the breakout. for best swing trading ideas

5. MACD (Moving Average Convergence Divergence) Strategy

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-day EMA (exponential moving average) from the 12-day EMA. A signal line (9-day EMA) is then plotted on top of the MACD line, functioning as a trigger for buy and sell signals.

•How it works:

• When the MACD line crosses above the signal line, it generates a buy signal.

• When the MACD line crosses below the signal line, it generates a sell signal.

Example:

A stock’s MACD line might cross above the signal line at the same time that the stock is showing upward momentum, indicating a potential buying opportunity.

• Why it works: The MACD helps traders identify changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

•Pro Tip: Use the MACD in combination with other indicators, such as RSI or moving averages, to confirm your signals.

Conclusion

Swing trading offers great flexibility and the potential for consistent profits. The key to successful swing trading lies in employing strategies that are based on solid technical analysis, understanding the market trends, and combining indicators to validate trade decisions. Whether you prefer the simplicity of moving averages or the precision of Fibonacci retracement, each of these five strategies can help you achieve your swing trading goals.

To recap, the 5 proven swing trading strategies are:

1. Moving Average Crossover Strategy

2.RSI Strategy

3. Fibonacci Retracement Strategy

4.Breakout Strategy

5.MACD Strategy

Swing trading isn’t just about watching charts and analyzing numbers; it’s as much a mental game as it is a technical one. The psychology behind swing trading can be the difference between consistent profits and constant stress. Let’s explore the mental qualities that swing traders need to succeed and how these impact their daily experience.

1. Getting Comfortable with Uncertainty

- Swing traders are in a constant state of “I don’t know.” They have to hold onto trades for several days or even weeks, never fully sure if the market will cooperate or surprise them overnight. Successful swing traders get used to this feeling of predictability.

- It’s like being on a road trip where the GPS can only give hints about the road ahead. They learn to trust the process and make peace with the fact that certainty is a luxury they don’t have.

2. Managing Emotions and Practicing Patience

- When holding a trade for days, patience is essential. Markets can make big moves overnight, and sometimes those moves are scary! But swing traders don’t want to be at the mercy of their emotions.

- Imagine watching a seesaw: it dips down and rises up. For a swing trader, that’s what their trades do, too. They learn to keep calm, ignore the noise, and resist the urge to react to every up and down. This patience helps them avoid mistakes like selling too soon or holding onto losses.

3. Sticking to a Plan (No Matter What)

- A big part of swing trading is sticking to a plan even when emotions try to take the wheel. This plan usually includes set rules for entering and exiting trades.

- Just like following a recipe, they stick to the ingredients (like indicators or price levels) and trust the steps even if they’re tempted to add a bit of “emotion” spice. Consistency is what makes their strategy work over time, not impulsive changes.

4. Decision-Making Under Pressure

- Although swing traders don’t face the same split-second pressure as day traders, they still have to make tough calls with time limits. When news drops overnight or a stock makes a sudden move, they need to decide—quickly—whether to stick with the plan or make a move.

- They learn to keep a cool head, weighing the pros and cons without letting stress drive their choices. Staying calm and collected helps them avoid impulsive decisions that could lead to losses.

5. Being Flexible and Open to Change

- Swing traders often adapt based on how the market is behaving. They don’t want to be stuck on “one right way” to trade because the market changes all the time.

- Imagine being a surfer: you wouldn’t try to ride every wave the same way. Sometimes you have to adjust your stance or pivot to stay afloat. Swing traders know when it’s time to switch things up and let go of what isn’t working.

6. Overcoming Fear of Losses

- No one likes losing, but in swing trading, losses are inevitable. The difference is that good swing traders learn not to let those losses define them.

- They treat losses as lessons, learning from each one rather than obsessing over it. It’s like playing a sport—losing one game doesn’t mean you’ll lose every game. Instead of fearing loss, they focus on improving and staying in the game.

7. Balancing Risk with Resilience

- Swing traders accept that they’re taking calculated risks. They know the market can be unpredictable, and they build up resilience to handle the emotional ups and downs.

- Think of it like climbing a mountain. There will be times they slip, but they’ve trained themselves to keep going, focusing on one step at a time. That resilience keeps them in the game even when they face setbacks.

8. Focusing on Process Over Profit

- It’s easy to get hooked on the idea of winning big. But successful swing traders are in it for the long haul. Instead of obsessing over the outcome of every trade, they focus on sticking to their routine and improving their skills.

- They know that when they follow their plan and stay disciplined, the profits will come naturally. This focus on the journey instead of the destination keeps them grounded and helps them avoid burnout.

9. Curiosity and Continuous Learning

- Swing traders are always learning. Markets change, and they know they need to stay curious and up-to-date. They study past trends, patterns, and market psychology to get better.

- It’s like any craft—you keep sharpening your skills over time. The more they learn, the more confident they feel, and that confidence helps them stay calm and collected through all kinds of market conditions.

10. Avoiding Mental Pitfalls Like Overconfidence

- One of the biggest traps in swing trading is getting overconfident, especially after a winning streak. They know the market can humble anyone, so they stay grounded.

- They’re also wary of confirmation bias, where they might ignore red flags because they’re “sure” about their trade. By keeping an open mind, they avoid tunnel vision and stay more objective about what the market is actually telling them.

In Summary

Successful swing traders are a mix of calm, flexible, and disciplined. They’ve trained themselves to handle the unknowns, control their emotions, and stay focused on the process, not just the profit. It’s a journey of self-awareness and growth as much as it is about market skill. For swing traders, mindset isn’t just a “nice-to-have”—it’s essential for weathering the ups and downs of the market with confidence and resilience.

By mastering these strategies, you can confidently trade with an edge, capitalizing on the market’s swings to maximize your profits. Trade and invest at your own discretion. We do not certify profits by these strategies.

Update: Oct 24, 2024

Update: Oct 24, 2024 8 mins

read

8 mins

read