Top 10 Books to Learn About the Stock market.

Top 10 Books to Learn About the Stock market. The stock market can be an intimidating place for beginners. Terms like “bull markets,” “dividends,” and “price-to-earnings ratios” often sound like a foreign language to the uninitiated. However, the key to success in stock investing is knowledge—and one of the best ways to gain that knowledge … Continue reading "Top 10 Books to Learn About the Stock market."

Top 10 Books to Learn About the Stock market.

The stock market can be an intimidating place for beginners. Terms like “bull markets,” “dividends,” and “price-to-earnings ratios” often sound like a foreign language to the uninitiated. However, the key to success in stock investing is knowledge—and one of the best ways to gain that knowledge is through reading. read more about stock market at https://mavianalytics.com

If you’re eager to learn about the stock market but don’t know where to start, you’re in luck. The following list of the top 10 books on learning the stock market will equip you with the tools to navigate the financial world with confidence. Whether you’re a novice investor or someone looking to sharpen your skills, these books will offer insights and strategies from some of the most successful investors and financial thinkers in history.

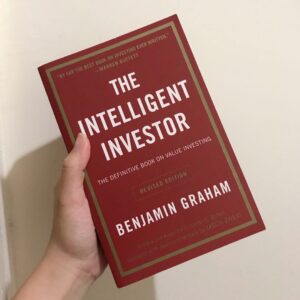

1. “The Intelligent Investor” by Benjamin Graham

If there’s a Bible for stock market investors, this is it. Benjamin Graham’s “The Intelligent Investor” is often hailed as the definitive book on value investing. Graham, considered the father of value investing, teaches readers how to analyze stocks, understand financial statements, and make sound investment decisions. Warren Buffett, one of the most successful investors of all time, calls this book the best book on investing ever written.

Key Takeaway: Focus on long-term investing based on fundamental analysis rather than short-term market fluctuations.you can buy them all at amazon.in and amazon.com

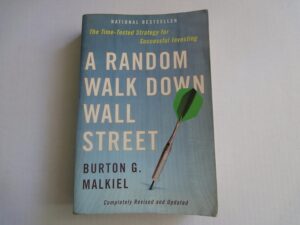

2. “A Random Walk Down Wall Street” by Burton G. Malkiel

For those who find themselves overwhelmed by the complexities of stock picking, “A Random Walk Down Wall Street” presents an alternative view. Malkiel’s book introduces the concept of efficient markets and makes the case for passive investing, such as index funds, which can often outperform more active strategies.

Key Takeaway: Stock prices reflect all available information, so trying to beat the market consistently is very difficult.

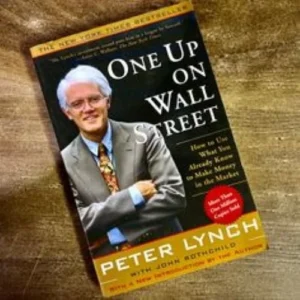

3. “One Up On Wall Street” by Peter Lynch

Peter Lynch, legendary manager of the Magellan Fund at Fidelity, shares his straightforward approach to investing in “One Up On Wall Street.” Lynch argues that individual investors have a leg up on professionals because they can spot trends in everyday life before Wall Street catches on. His advice on how to find “tenbaggers”—stocks that return 10 times your initial investment—is particularly valuable for those who want to pick stocks on their own.

Key Takeaway: Invest in what you know and have an edge over institutional investors by observing companies and products in your daily life.

4. “Common Stocks and Uncommon Profits” by Philip Fisher

Philip Fisher’s classic work, “Common Stocks and Uncommon Profits,” takes a deep dive into growth investing. Fisher focuses on qualitative factors, such as a company’s management and its ability to innovate. His methodology is centered on finding companies that offer long-term growth potential rather than undervalued companies.

Key Takeaway: Thoroughly investigate a company’s management, product lines, and long-term growth potential before investing.

5. “Market Wizards” by Jack D. Schwager

“Market Wizards” is a unique book that features interviews with some of the greatest traders and investors of the 20th century. Schwager gives readers a glimpse into the minds of traders who have made fortunes in the stock market. Through these interviews, the book covers a range of trading philosophies, including technical analysis, fundamental analysis, and trend following.

Key Takeaway: There’s no one-size-fits-all approach to stock market success. Learn from the experiences and mistakes of top traders.

6. “Reminiscences of a Stock Operator” by Edwin Lefèvre

Originally published in 1923, “Reminiscences of a Stock Operator” is a semi-autobiographical account of the legendary stock trader Jesse Livermore. While the book primarily focuses on speculative trading, it provides invaluable lessons on market psychology, the dangers of overtrading, and how emotional control is crucial to success in the stock market.

Key Takeaway: Understanding market psychology is just as important as analyzing financial metrics when trading stocks.

7. “The Little Book of Common Sense Investing” by John C. Bogle

John C. Bogle, the founder of Vanguard and creator of the first index fund, penned “The Little Book of Common Sense Investing” to advocate for a simple yet powerful investing strategy: low-cost index fund investing. Bogle argues that most investors, both amateur and professional, would be better off focusing on diversified index funds rather than trying to pick individual stocks.

Key Takeaway: The best way to build wealth is through long-term, low-cost index investing, allowing the power of compound interest to work in your favor.

8. “The Essays of Warren Buffett: Lessons for Corporate America” by Warren Buffett & Lawrence Cunningham

This book is a collection of letters and essays from Warren Buffett to Berkshire Hathaway shareholders over the years. Compiled by Lawrence Cunningham, “The Essays of Warren Buffett” offers a clear, no-nonsense guide to Buffett’s investment philosophy. Topics such as corporate governance, mergers and acquisitions, and, of course, investing principles are all discussed in Buffett’s distinct, candid style.

Key Takeaway: A focus on quality companies with durable competitive advantages will yield better long-term results than chasing speculative investments.

9. “How to Make Money in Stocks” by William J. O’Neil

William J. O’Neil is the founder of Investor’s Business Daily and a pioneer in the use of technical analysis. “How to Make Money in Stocks” introduces O’Neil’s CAN SLIM method, which combines both technical and fundamental analysis to identify high-growth stocks. The book is particularly useful for those who want to learn how to balance a stock’s price action with its underlying fundamentals.

Key Takeaway: A successful investment strategy involves both understanding a company’s fundamentals and tracking its stock price behavior.

10. “The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, & Michael LeBoeuf

Named after John Bogle, the creator of the index fund, the “Bogleheads’ Guide to Investing” is written by a group of investors who follow Bogle’s low-cost, passive investing philosophy. The book covers everything from how to build a diversified portfolio to understanding taxes and avoiding common investment pitfalls.

Key Takeaway:

Simplicity and discipline are the keys to successful investing. Avoid high fees, stick with diversified funds, and stay the course.

Why These Books Matter for Aspiring Investors

Learning to navigate the stock market is akin to learning a new language. You need to understand the terminology, the underlying principles, and the many strategies that can be employed in both bullish and bearish markets. These 10 books provide a solid foundation for anyone looking to gain a comprehensive understanding of stock investing.

But why read books when there are so many online resources? While blogs, forums, and YouTube channels can offer great insights, books allow for a more in-depth exploration of concepts, often with more structure and clarity. They also give you direct access to the minds of some of the greatest investors of all time.

By absorbing the lessons from these texts, you’ll be better equipped to:

•Understand market fundamentals.

•Evaluate different investment strategies.

•Recognize the importance of both emotional discipline and rational analysis.

•Build a well-rounded, diversified portfolio.

How to Choose the Right Book for You

While all these books are excellent resources, your choice depends on your current level of understanding and your investment goals. If you’re a beginner, start with “The Little Book of Common Sense Investing” or “A Random Walk Down Wall Street” to grasp the basics of passive investing. If you’re looking to dive into individual stock analysis, then “The Intelligent Investor” or “One Up On Wall Street” would be more up your alley.

Final Thoughts

The stock market offers immense potential for wealth creation, but success requires education, patience, and discipline. By reading the right books and absorbing lessons from seasoned experts, you’ll be setting yourself up for long-term success. Each of the books on this list provides something different, from growth investing strategies to the psychology behind trading.

So, grab a cup of coffee, settle into a comfortable chair, and start reading. The road to financial literacy and investment success begins with the first page.

Update: Oct 24, 2024

Update: Oct 24, 2024 8 mins

read

8 mins

read